2009 Secondary Peer Group. The Compensation Committee also approved a Secondary Peer Group of 20 companies from a broad range of industries (except the financial services, healthcare, cable/satellite, telecommunications and media industries) with 2008 annual revenues of $7.5 billion to $32.5 billion (approximately 50% to 200% of the Company’s 2008 annual revenues) and median 2008 annual revenues of $17.7 billion. The Secondary Peer Group consists of the following companies:

Amgen Inc.

Burlington Northern Santa Fe Corporation

Dominion Resources, Inc.

Eli Lilly & Company

EMC Corporation

Exelon Corporation

Freeport-McMoRan Copper & Gold Inc.

General Mills, Inc.

Google Inc.

Kimberly-Clark Corporation

Medtronic, Inc.

Occidental Petroleum Corporation

Raytheon Company

Schering-Plough Corporation

Textron Inc.

The Southern Company

Union Pacific Corporation

Waste Management, Inc.

Weyerhaeuser Company

Xerox Corporation

Market Surveys. In addition to the 2009 Peer Groups, Management and the Compensation Committee considered, as a general reference, market compensation survey data available through a number of nationally-recognized compensation consulting firms. This data covers companies roughly comparable in size (median annual 2008 revenuesrevenue of approximately $16$18 billion) to the Company from a broad range of industries, including the cable/satellite, telecommunications and media industries.

The Use of Pay Tallies.Tallies

The Compensation Committee periodically reviews “pay tallies” for the named executive officers (i.e.(i.e., analyses of the executives’ annual pay and long-term compensation with potential severance payments under various termination scenarios, including involuntary termination scenarios, pursuant to the negotiated employment agreements) to help ensure that the design of the compensation program is consistent with the Company’s compensation philosophy and key principles and that the amount of compensation is within appropriate competitive parameters.

Based on the Compensation Committee’s review of 20092012 pay tallies, the Compensation Committee has concluded that the total compensation of the named executive officers (and, in the case of involuntary termination orchange-in-control scenarios, potential payouts) continues to be appropriate in light of the Company’s compensation philosophy and guiding principles and is appropriate andconsistent with relevant competitive marketplace data.

The Role of Employment Agreements

Each of the named executive officers is employed pursuant to a multi-year employment agreement that reflects the individual negotiations with the relevant named executive officer. The Company has long used such agreements to foster retention, to be competitive and therefore, didto protect the business with restrictive covenants, such as non-competition, non-solicitation and confidentiality provisions, and, in some cases, “clawback” rights (i.e., rights to recover compensation paid to an executive if the Company subsequently determines that the compensation was not make any adjustments based on this review.

2009 Base Salary and Target Incentive Compensation Determinations

As noted above, as a resultproperly earned). The employment agreements provide for severance pay in the event of the

prevailing uncertainty aboutinvoluntary termination of the

U.S. economyexecutive’s employment without cause, which serves as consideration for the restrictive covenants, provides financial security to the executive and

its impactallows the executive to remain focused on the Company’s

business,interests at all times.The employment agreement for each named executive officer is described in detail in this Proxy Statement under “—Employment Agreements,” “—Potential Payments upon Termination of Employment” and “—Potential Payments upon a Change in Control,” below.

The Role of Stockholder Advisory Vote on Executive Compensation

The Company provides its stockholders with the opportunity to cast an annual advisory vote on executive compensation (a “say-on-pay vote”). At the Company’s annual meeting of stockholders in May 2012, 95% of the votes cast on the say-on-pay vote were voted in favor of management’s proposal. The Compensation Committee believes that this vote indicates stockholders’ support of the Company’s approach to executive compensation. Accordingly, the Compensation Committee did not increasechange its approach in 2012 or 2013 in light of these results and its continued belief that the Company’s executive compensation program reflects its philosophy and goals. The Compensation Committee will continue to consider the outcome of the Company’s say-on-pay vote when making future compensation decisions for the named executive officers’ base salaries or short-term or long-term incentive target levels for 2009. Any changeofficers.

|

Additional Executive Compensation Information |

Ownership and Retention Requirements; Hedging Policy

Beginning in 2011, the Company adopted stock ownership requirements that, following a five-year phase-in period, require that covered officers hold stock (including in the total cash compensation ultimately paidform of unvested RSUs (other than those then subject to each named executive officer for 2009 was dependent upon payouts under the Company’ssatisfaction of performance criteria)) in an amount equal to or exceeding a multiple of their annual bonus plan, which were determined in part based on the achievementbase salary. As of certain Company financial performance goals, and in part based onJanuary 31, 2013, each executive’s performance against individual goals. The ultimate value of the named executive officers would have met his or her ownership requirement if the phase-in period had expired.

| | | | |

| Title | | Stock Ownership Requirement

Multiple of Annual Base Salary | |

Chief Executive Officer | | | 6.0X | |

Chief Operating Officer | | | 3.5X | |

Chief Financial Officer | | | 3.5X | |

Other Executive Officers (and Executive Vice Presidents) | | | 2.0X | |

Under the ownership requirements, the Company will review covered officers’ 2009 long-term incentive awardscompliance on January 31 of each calendar year. If an officer is not in compliance with the requirement within a five-year phase-in period (January 31, 2016 for all named executive officers other than Ms. Esteves), he or she will depend on futurebe required to retain at least 50% of any stock performance. received upon exercise of stock options or vesting of RSUs (after shares used to cover exercise costs, taxes, etc.). Prior to the full implementation of the requirements, the executive officers must obtain consent from the Chief Executive Officer if a sale of Common Stock would cause the executive to no longer satisfy the ownership requirement. The Compensation Committee will also consider the executive officers’ compliance with the ownership and retention requirements in determining compensation.

Under the Company’s securities trading policies, executive officers and directors of the Company may not engage in hedging strategies using puts, calls, straddles, collars or other similar instruments involving the Company’s securities, except under very limited circumstances with the Company’s approval. None of the Company’s executive officers has pledged Company Common Stock.

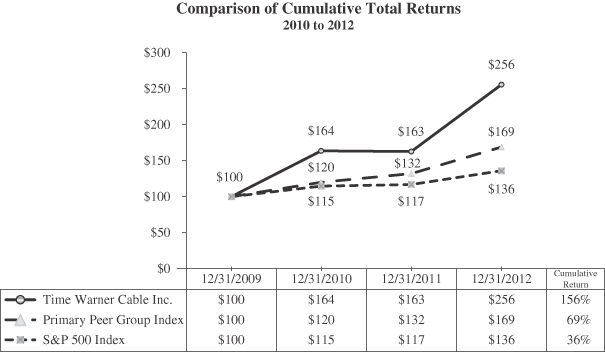

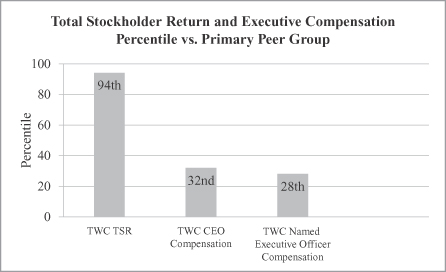

Positive Relationship between Total Stockholder Return and Compensation

The Company believes that its executive compensation philosophyprogram maintains a strong relationship between pay and key principles,performance. To evaluate the link between executive compensation and performance, some stockholders and their advisors focus on the relationship between a company’s total stockholder return (“TSR”) and its chief executive officer’s and named executive officers’ compensation. Under one approach, such stockholders compare the percentile ranking of the company’s TSR (relative to a peer group) with the percentile ranking of the company’s executive compensation levels (relative to the same peer group). Each of these relative rankings is based on TSR and annual compensation over the most recent one- and three-year periods, weighted 40% and 60% respectively.

For the convenience of stockholders interested in this analysis, the Company has prepared the following chart, which illustrates that the Company enjoys apositive relative relationship between TSR and executive compensation. Specifically, relative to its Primary Peer Group, the Company’s one- and three-year weighted TSR ranked at the 94thpercentile, while Mr. Britt’s compensation ranked at only the 32nd percentile and the other factors noted above, were properly reflected in the 2009 target and actual compensation for each named executive officer, including base salary, short-term and long-term incentives, andofficers’ compensation (including Mr. Britt) ranked at only the mix of compensation elements.

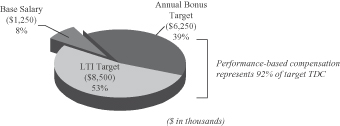

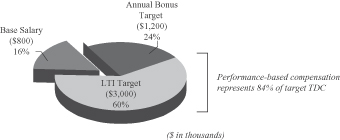

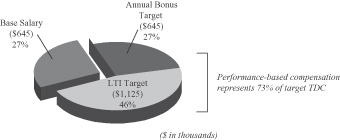

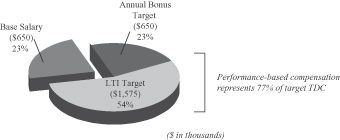

Each named executive officer’s 2009 base salary and target short-term and long-term incentive compensation were as follows:

Mr. Britt. The Compensation Committee reviewed Mr. Britt’s 2009 compensation in January 2009. Under Mr. Britt’s then-current employment agreement, he was to receive a minimum annual salary of $1 million, the right to participate in the Company’s annual bonus plan with a target award of $5 million (500% of base salary) and long-term incentives valued at $6 million (600% of base salary).

27

of the Company’s 20092012 incentive programs, the nature of the risks that these features might give rise to and certain mitigating factors.

The Compensation Committee concluded that the Company’s executive incentive programs do not incentivize excessive risk takingrisk-taking or inappropriate conservatism in behavior and decisionmaking.decision-making. Among the factors giving rise to the Compensation Committee’s determination were the following:

The Company’s compensation programs for the named executive officers provide a balanced mix of cash and equity, stock options and RSUs, and annual and longer-term incentives.

| | |

| • | The Company’s compensation programs for the named executive officers provide a balanced mix of cash and equity, stock options and RSUs, and annual and longer-term incentives. |

|

| • | Short-term incentives are designed to require the Company to reach “stretch” (but not unrealistic) targets and provide for a range of potential payout levels depending on performance above a minimum threshold level. |

|

| • | Maximum annual bonus payout levels are limited to 150% of target compensation. |

|

| • | The Compensation Committee has significant discretion in determining payouts under the Company’s annual cash bonus plans and can use its discretion to ensure that neither excessive risk-taking nor inappropriate conservatism in decisionmaking is rewarded. |

Although not a direct result of the 2009 risk assessment, the Company is instituting certain changes to its compensation programsreach “stretch” (but not unrealistic) targets and practicesprovide for 2010. See “—Looking Forward.”

Ownership and Retention Guidelines

During 2009, the Compensation Committee considered imposing a requirement that certain senior officers hold designatedrange of potential payout levels depending on performance above a threshold level.

Maximum annual bonus payout levels are limited to 150% of Company stockand/or RSUs (“ownership guidelines”). target annual bonus.

The Compensation Committee declined to adopt such guidelines,has discretion in determining that the named executive officers’ holdings of Company stock options and unvested RSUs provided a sufficient level of personal exposure to the value ofpayouts under the Company’s stockannual cash bonus plans and can use its discretion to support alignment with the interests of the Company’s stockholders.

The Compensation Committee also was concerned, under current circumstances,ensure that ownership guidelines would resultneither excessive risk-taking nor inappropriate conservatism in the Company’s executive officers having an excessive proportion of their personal wealth in the Company’s stock, limiting diversification and prudent personal wealth management, and thereby potentially resulting in inappropriately conservative behavior and decisionmaking in an effort to preserve the value of their holdings.decision-making is rewarded.

The Company expects that the Compensation Committee will monitor the named executive officers’ Company stock holdings and review its ownership guidelines determination annually.

The Company provides somea very limited number of perquisites to the named executive officers. TheWhere provided, the Company believes these perquisites facilitate the operation of its business, allow named executive officers to better focus their time, attention and capabilities on their Company activities, address safety and security concerns and assist the Company in recruiting and retaining key executives.

The Company’s perquisites for its named executive officers in 20092012 included, reimbursement for financial services and, in the case of Mr. Britt, a car allowance (eliminated in 2010) as well as a Company-provided car and specially-trained driver in light of security concerns. All the named executive officers were also eligible for reimbursement for certain financial services (e.g., tax and estate planning). Effective January 1, 2013, only Messrs. Britt and Marcus and Ms. Esteves are eligible for financial services reimbursement. At the request of the Company’s Board, Mr. Britt usesCompany-owned or leased aircraft for business and personal travel under most circumstances. WithIn limited instances, with CEO approval, personal use of the aircraft is occasionally permitted by the Company’s other executive officers (including(as well as guests of such executive officers) are permitted to join an otherwise scheduled business-purpose Company flight for their family members) on flights that are or would be scheduled for businesspersonal purposes. The Company imputes income to executive officers who make personal use of Company aircraft as and when required under applicable tax rules.

33

BenefitsBenefits

The Company maintains defined benefit and defined contribution retirement programs for its employees in which the Company’s named executive officers participate.participate, subject to satisfaction of eligibility requirements. The objective of these programs is to help provide financial security into retirement, reward and motivate tenure and recruit and retain talent in a competitive market. In addition to the Company’s tax-qualified defined benefit plan, the Company maintains a nonqualified defined benefit plan in which the named executive officers participate. The tax-qualified defined benefit plan has a maximum compensation limit and a maximum annual benefit imposed by the tax laws, which limit the benefit to participants whose compensation exceeds these limits.under the plan for certain participants. In order to provide a retirement benefitsbenefit more commensurate with salary levels, the nonqualified defined benefit plan provides benefits to key salaried employees, including the named executive officers, using the same formula for calculating benefits as is used under the tax-qualified defined benefit plan but taking into account compensation in excess of the compensation limitations for the tax-qualified defined benefit plan (upup to an aggregate limita cap of $350,000 per year)year and determined without regard to the maximum annual benefit accruals forunder the tax-qualified plan. See “—Pension Plans.”

The Company sponsors otheralso maintains a nonqualified deferred compensation plansplan to which contributions by the Company or employees are no longer permitted. See “—Nonqualified Deferred Compensation.”

Each of the named executive officers is employed pursuant to a multi-year employment agreement that reflects the individual negotiations with the relevant named executive officer. The Company has long used such agreements to foster retention, to be competitive and to protect the business with restrictive covenants, such as non-competition, non-solicitation and confidentiality provisions. The employment agreements provide for severance pay in the event of the termination of the executive’s employment without cause, which serves as consideration for the restrictive covenants, provides financial security to the executive, and allows the executive to remain focused on the Company’s interests at all times.

During 2009, the Company’s CEO, Chief Operating Officer and Senior Executive Vice President and Chief Financial Officer entered into new employment agreements. The Company’s other two named executive officers entered into amendments to their respective employment agreements during 2009. The employment agreement for each named executive officer is described in detail in this Proxy Statement under “—Employment Agreements” and “—Potential Payments upon Termination or Change in Control.”

Tax Deductibility of Compensation

Section 162(m) generally disallows a tax deduction to public corporations for compensation in excess of $1,000,000$1 million in any one year with respect to each of its Chief Executive Officer and three most highly paid executive officers (other than the Chief Financial Officer) with the exception of compensation that qualifies as performance-based compensation. The Compensation Committee considers Section 162(m) implications in making compensation recommendations and in designing compensation programs for the executives. In this regard, the 162(m) Bonus Plan and the TWC2006 and 2011 Stock Incentive PlanPlans were submitted to and approved by stockholders in May 2007 so that compensation paid under those plans may qualify as performance-based compensation under Section 162(m). However, the Compensation Committee retains the discretion to pay compensation that is not deductible, whether under such plans or otherwise, when it determines that to be in the best interests of the Company and its stockholders. For 2009,2012, the Company believes that the salary and cash bonuses paid to the named executive officers subject to Section 162(m) will be deductible, except for certain amounts primarily relatedMr. Britt’s annual salary to payments under the2006-2008 Cash Long-Term Incentive Plan, which were fully paid out extent it exceeded $1 million. RSUs that vested in early 2009,2012 are not considered performance-based for tax purposes and will be subject to the vestingdeduction limitations of RSUsSection 162(m). However, in 2009.

Separation from Time Warner

In connection with the Separation, in March 2009,2011 and 2012, the Company paid the Special Dividend on its Common Stock and effectuated a1-for-3 Reverse Stock Split. The Special Dividend was $10.27 per share ($30.81 per share after adjustment for the Reverse Stock Split). The impact of these events on the Company’s LTI program is discussed below.

34

Company RSUs. As required under the TWC Stock Incentive Plan, the number ofgranted RSUs held by each holder was adjustedwith performance-based vesting criteria to reflect the Reverse Stock Split. In connection with the payment of the Special Dividend, under the Company’s award agreements, RSU holders were to be credited with a deferred cash payment of $10.27 for each share of Company Common Stock underlying their RSUs (without interest) until the vesting of the related RSUs. Based on Management’s recommendation, the award agreements were amended to give holders the option of receiving additional RSUs (the “Special Dividend RSUs”) in lieu of this retained cash distribution (the “Special Dividend retained cash distribution”). The Compensation Committee determined that providing this option would enable employees to maintain their equity interest in the Company and thus facilitate the alignment of their interests with those of stockholders.

RSU holders wishing to receive the additional Special Dividend RSUs in lieu of the Special Dividend retained cash distribution were required to make such election by December 22, 2008. The number of Special Dividend RSUs awarded on March 12, 2009, the Special Dividend payment date, to those holders who made such an election was equal to the product of the Special Dividend and their outstanding RSUs divided by the Common Stock closing price on the Special Dividend payment date ($8.33 per share ($24.99 after adjustment for the Reverse Stock Split)). The Special Dividend RSUs and the Special Dividend retained cash distribution have the same vesting dates as the related RSUs.

Company Stock Options. In connection with the payment of the Special Dividend and the Reverse Stock Split, the Compensation Committee authorized equitable adjustments (the “antidilution adjustments”) to the number of shares covered by, and the exercise prices of, outstanding Company stock options, to maintain the fair value of those awards. These antidilution adjustments were made pursuant to the existing antidilution provisions of the TWC Stock Incentive Plan and the related award agreements. As an example of the operation of these adjustments, an employee holding stock options representing the right to purchase 1,000 shares of Common Stock at $37.05 per share before the Special Dividend payment, the Reverse Stock Split and the antidilution adjustments described above, would have stock options to purchase 772 shares of Common Stock at $47.95 per share after the antidilution adjustment.

“Make-up” Awards. As a result of the Separation, under the terms of Time Warner’s equity plans and related award agreements, Company employees with outstanding Time Warner equity awards, including the named executive officers were treated as if their employment with Time Warner was terminated without cause as of March 12, 2009. This resulted in most of the Company’s employees forfeiting their unvested Time Warner stock options and in the truncation of the exercise periods for their vested Time Warner stock options (to one year after the Separation in most cases). Most Company employees holding Time Warner RSUs vested in these RSUs pro rata upon Separation (i.e., based on the number of days elapsed between the original grant date and the original vesting date) and forfeited the remainder of their RSUs awards.

Company employees who qualified as “retirement eligible” under the Time Warner equity plans at the time of Separation received different treatment. Among the named executive officers, Mr. Britt qualified as retirement eligible under the Time Warner plans and, as a result, his Time Warner stock options and RSUs vested upon the Separation. Under the terms of Mr. Marcus’s then-current employment agreement, his Time Warner stock options and RSUs also vested upon Separation. Mr. Britt’s and Mr. Marcus’s Time Warner stock options remain exercisable for five years and three years, respectively, following the Separation (but not beyond their original expiration dates).

Pursuant to a plan approved by the Compensation Committee in August 2008, in March 2009, the Compensation Committee approved“make-up” grants of Company stock options and RSUs (the “Separation-relatedmake-up awards”), or in certain instances, cash payments, to Company employeesthat are intended to offsetbe exempt from the lossdeduction limitations of economic valueSection 162(m) when they vest (scheduled to occur in Time Warner equity awards as a result of the Separation. The Separation-relatedmake-up awards were designed to offset the loss of economic value in Time Warner equity awards as a result of the Separation. The specific terms of the named executive officers’ Separation-relatedmake-up awards were approved by the Compensation Committee on May 8, 2009 with a grant date of May 11, 2009.

35

Looking Forward

The Company’s Management and the Compensation Committee have evaluated the structure of the short-term and long-term incentive programs. While the Company believes that the philosophy, key principles and compensation elements in place for 2009 are still generally appropriate for 2010, the Company has instituted a number of changes to its compensation practices that will generally become effective in 2010:

| | |

| • | Consistent with the employment agreements that the CEO, Chief Operating Officer and Chief Financial Officer entered into during 2009, the Company is using a new form of executive employment agreement that contains: |

| | |

| Ø | a “clawback” feature, which allows the Company to recover certain compensation paid to the executive if it subsequently determines that the compensation was not properly earned; |

|

| Ø | a “double trigger”change-in-control provision, which limitschange-in-control severance benefits to circumstances in which the Company undergoes abona fidechange in controland the executive is terminated (a similar provision is incorporated into the equity award agreements); and |

|

| Ø | no potential for an executive to receive “gross up” payments in respect of the executive’s tax liability. |

| | |

| • | For 2010, the Company’s Chief Operating Officer and Chief Financial Officer will both receive a larger percentage of their total direct compensation in the form of long-term incentive compensation than in 2009. |

|

| • | For 2010, partially in response to increasing compensation levels at companies in the 2009 Primary Peer Group, each of the Company’s named executive officers received an increase in total compensation, including an increase in base salary and, in some cases, short-term and long-term incentive targets. See “—Employment Agreements.”) |

|

| • | For 2010, the Company has increased the portion of the annual cash bonus attributable to Company financial performance from 70% to 80%, and has increased the number of financial measures used to determine the Company’s financial performance. |

Compensation Committee Report

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis with Management and, based on such review and discussions, the Compensation Committee recommended to the

Board of Directors that the Compensation Discussion and Analysis be included in this Proxy Statement and the Company’s Annual Report onForm 10-K (by reference).

Members of the Compensation Committee

| | | | |

| Peter R. Haje (Chair) | | Thomas H. CastroN.J. Nicholas, Jr. | | |

| Carole Black | | N.J. Nicholas, Jr.Edward D. Shirley | | |

36

Summary Compensation Table

The following table presents information concerning total compensation paid to the Company’s Chief Executive Officer, Chief Financial Officer and each of its three other most highly compensated executive officers who served in such capacities on December 31, 20092012 (collectively, the “named executive officers”). Additional information regarding salary, incentive compensation and other components of the named executive officers’ total compensation is provided under “—Compensation Discussion and Analysis.”

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Change in

| | | | |

| | | | | | | | | | | | | | | Pension

| | | | |

| | | | | | | | | | | | | | | Value and

| | | | |

| | | | | | | | | | | | | | | Nonqualified

| | | | |

| | | | | | | | | | | | | Non-Equity

| | Deferred

| | All

| | |

| | | | | | | | | Stock

| | Option

| | Incentive Plan

| | Compensation

| | Other

| | |

Name and Principal Position | | Year | | Salary | | Bonus | | Awards(3) | | Awards(4) | | Compensation(5) | | Earnings(6) | | Compensation(7) | | Total |

| |

| Glenn A. Britt(1) | | | 2009 | | | $ | 1,000,000 | | | | — | | | $ | 2,324,387 | | | $ | 5,923,289 | | | $ | 6,250,000 | | | $ | 177,092 | | | $ | 264,621 | | | $ | 15,939,389 | |

| Chairman, President | | | 2008 | | | $ | 1,000,000 | | | | — | | | $ | 2,860,050 | | | $ | 4,042,042 | | | $ | 6,434,270 | | | $ | 120,950 | | | $ | 82,534 | | | $ | 14,539,846 | |

| and Chief Executive Officer | | | 2007 | | | $ | 1,000,000 | | | | — | | | $ | 4,444,481 | | | $ | 2,369,660 | | | $ | 7,825,671 | | | $ | 36,370 | | | $ | 89,896 | | | $ | 15,766,078 | |

| Robert D. Marcus(2) | | | 2009 | | | $ | 800,000 | | | | — | | | $ | 697,338 | | | $ | 1,126,614 | | | $ | 1,750,000 | | | $ | 34,790 | | | $ | 24,447 | | | $ | 4,433,189 | |

| Senior Executive | | | 2008 | | | $ | 800,000 | | | | — | | | $ | 858,037 | | | $ | 1,131,697 | | | $ | 1,970,711 | | | $ | 22,160 | | | $ | 30,352 | | | $ | 4,812,957 | |

| Vice President and Chief Financial Officer | | | 2007 | | | $ | 700,000 | | | | — | | | $ | 1,000,017 | | | $ | 473,976 | | | $ | 1,249,500 | | | $ | 26,260 | | | $ | 12,986 | | | $ | 3,462,739 | |

| Landel C. Hobbs | | | 2009 | | | $ | 900,000 | | | | — | | | $ | 1,346,336 | | | $ | 1,886,773 | | | $ | 2,625,000 | | | $ | 30,920 | | | $ | 32,337 | | | $ | 6,821,366 | |

| Chief Operating Officer | | | 2008 | | | $ | 895,192 | | | | — | | | $ | 1,430,025 | | | $ | 1,886,161 | | | $ | 3,024,849 | | | $ | 8,160 | | | $ | 48,546 | | | $ | 7,292,933 | |

| | | | 2007 | | | $ | 850,000 | | | | — | | | $ | 1,814,820 | | | $ | 860,178 | | | $ | 2,802,933 | | | $ | 24,330 | | | $ | 44,845 | | | $ | 6,397,106 | |

| Michael LaJoie | | | 2009 | | | $ | 525,000 | | | | — | | | $ | 399,712 | | | $ | 639,941 | | | $ | 660,188 | | | $ | 66,530 | | | $ | 16,635 | | | $ | 2,308,006 | |

| Executive Vice President | | | 2008 | | | $ | 525,000 | | | | — | | | $ | 437,959 | | | $ | 577,645 | | | $ | 858,807 | | | $ | 44,150 | | | $ | 14,911 | | | $ | 2,458,472 | |

| and Chief Technology Officer | | | 2007 | | | $ | 480,000 | | | | — | | | $ | 622,255 | | | $ | 294,917 | | | $ | 1,033,762 | | | $ | 50,370 | | | $ | 14,297 | | | $ | 2,495,601 | |

| Marc Lawrence-Apfelbaum | | | 2009 | | | $ | 550,000 | | | | — | | | $ | 382,495 | | | $ | 659,134 | | | $ | 687,500 | | | $ | 66,690 | | | $ | 16,490 | | | $ | 2,362,309 | |

| Executive Vice President, | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| General Counsel and Secretary | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | | Year | | | Salary | | | Bonus | | | Stock

Awards(1) | | | Option

Awards(2) | | | Non-Equity

Incentive

Plan

Compensation(3) | | | Change in

Pension

Value and

Nonqualified

Deferred

Compensation(4) | | | All Other

Compensation(5) | | | Total | |

Glenn A. Britt | | | 2012 | | | $ | 1,250,000 | | | $ | — | | | $ | 3,667,104 | | | $ | 5,164,373 | | | $ | 6,617,188 | | | $ | 141,250 | | | $ | 512,813 | | | $ | 17,352,728 | |

Chairman and Chief | | | 2011 | | | | 1,250,000 | | | | — | | | | 3,177,333 | | | | 4,244,191 | | | | 7,210,938 | | | | 111,910 | | | | 439,456 | | | | 16,433,828 | |

Executive Officer | | | 2010 | | | | 1,250,000 | | | | — | | | | 3,053,449 | | | | 4,395,270 | | | | 8,306,250 | | | | 120,480 | | | | 296,880 | | | | 17,422,329 | |

Robert D. Marcus(6) | | | 2012 | | | $ | 1,000,000 | | | $ | — | | | $ | 3,559,248 | | | $ | 2,734,098 | | | $ | 2,646,875 | | | $ | 127,320 | | | $ | 28,105 | | | $ | 10,095,646 | |

President and Chief | | | 2011 | | | | 1,000,000 | | | | — | | | | 1,906,371 | | | | 2,473,045 | | | | 2,884,375 | | | | 82,350 | | | | 33,435 | | | | 8,379,576 | |

Operating Officer | | | 2010 | | | | 904,932 | | | | — | | | | 1,262,123 | | | | 1,742,950 | | | | 2,059,040 | | | | 43,130 | | | | 31,239 | | | | 6,043,414 | |

Irene M. Esteves(7) | | | 2012 | | | $ | 800,000 | | | $ | 240,000 | | | $ | 1,294,272 | | | $ | 1,822,732 | | | $ | 1,270,500 | | | $ | 22,830 | | | $ | 23,083 | | | $ | 5,473,417 | |

Executive Vice President and Chief Financial Officer | | | 2011 | | | | 366,667 | | | | 820,000 | | | | 3,502,682 | | | | — | | | | 692,250 | | | | — | | | | 468,993 | | | | 5,850,592 | |

Michael LaJoie(8) | | | 2012 | | | $ | 642,000 | | | $ | — | | | $ | 485,352 | | | $ | 683,537 | | | $ | 679,365 | | | $ | 212,900 | | | $ | 17,996 | | | $ | 2,721,150 | |

Executive Vice | | | 2011 | | | | 620,833 | | | | — | | | | 463,354 | | | | 601,108 | | | | 716,286 | | | | 156,870 | | | | 17,386 | | | | 2,575,837 | |

President and Chief | | | 2010 | | | | 589,725 | | | | — | | | | 427,480 | | | | 590,361 | | | | 585,591 | | | | 94,790 | | | | 17,045 | | | | 2,304,992 | |

Technology and Network Operations Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Marc Lawrence-Apfelbaum | | | 2012 | | | $ | 645,400 | | | $ | — | | | $ | 679,493 | | | $ | 956,945 | | | $ | 679,365 | | | $ | 239,500 | | | $ | 50,391 | | | $ | 3,251,094 | |

Executive Vice | | | 2011 | | | | 616,667 | | | | — | | | | 542,320 | | | | 724,362 | | | | 692,250 | | | | 175,380 | | | | 19,126 | | | | 2,770,105 | |

President, General | | | 2010 | | | | 593,150 | | | | — | | | | 427,480 | | | | 590,361 | | | | 786,325 | | | | 103,780 | | | | 18,485 | | | | 2,519,581 | |

Counsel and Secretary | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| (1) | | Mr. Britt became Chairman of the Board effective March 12, 2009 and continues to serve as President and Chief Executive Officer. |

|

(2) | | Mr. Marcus became Senior Executive Vice President and Chief Financial Officer on January 1, 2008, having served as Senior Executive Vice President prior thereto. |

|

(3) | | Amounts set forth in the Stock Awards column represent the aggregate grant date fair value of TWC RSU awards and RSU awards subject to performance-based vesting conditions (“PBUs”) granted by the Company in each year included in the table, each as computed in accordance with FASBAccounting Standards Codification(ASC), Topic 718 (formerly FAS 123R) (“FASB ASC Topic 718”), disregarding estimates of forfeitures related to service-based vesting conditions.SEC rules. These amounts were calculated based on the closing sale price of the Common Stock on the NYSE on the date of grant.grant and, in the case of PBUs, based on the probability that the applicable performance goal would be achieved. See “Outstanding“—Outstanding Equity Awards.” For information about the assumptions used in these calculations, see Note 13 to the Company’s audited consolidated financial statements included in its Annual Report onthe 2012 Form10-K for the fiscal year ended December 31, 2009 (the “2009Form 10-K”). 10-K. The amounts set forth in the Stock Awards column do not represent the actual value that may be realized by the named executive officers. See “—Grants of Plan-Based Awards.” |

|

(4)(2) | | Amounts set forth in the Option Awards column represent the aggregate grant date fair value of stock option awards and stock option awards subject to performance-based vesting conditions (“PBOs”) with respect to Common Stock granted by the Company in each year included in the table, each as computed in accordance with FASB ASC Topic 718, disregarding estimatesSEC rules and, in the case of forfeitures related to service-based vesting conditions.PBOs, based on the probability that the applicable performance goal would be achieved. For information about the assumptions used in these calculations, see Notes 3 and 13 to the 20092012 Form 10-K and footnote (4)(2) to the table below entitled “Grants ofPlan-Based Awards During 2009.2012.” The actual value, if any, that may be realized by an executive officer from any stock option will depend on the extent to which the market value of the Common Stock exceeds the exercise price of the option on the date the option is exercised. Consequently, there is no assurance that the value realized by an executive officer will be at or near the value estimated above. These amounts should not be used to predict stock performance. None of the stock options reflected in the table was awarded with tandem stock appreciation rights. |

|

(5) | (3) | Amounts set forth in the Non-Equity Incentive Plan Compensation column for 2009 and earlier years represent amounts paid pursuant to the Company’s 162(m) Bonus Plan and TWCIP and, for 2008 and 2007, also include payments under the 2006 and 2005 Cash Long-Term Incentive Plans, which were three-year, performance-based cash award plans.TWCIP. For additional information regarding the Compensation Committee’s determinations with respect to annual bonus payments under the 162(m) Bonus Plan and 2012 TWCIP, see “—Compensation Discussion and Analysis—20092012 Short-Term Incentive Program and Awards.Program—Annual Cash Bonus.” |

37

| | |

(6) | (4) | These amounts represent the aggregate change in the actuarial present value of each named executive officer’s accumulated pension benefits under the Time Warner Cable Pension Plan, the Time Warner Cable Excess Benefit Pension Plan, the Time Warner Pension Plan and the Time Warner Excess Benefit Pension Plan, to the extent the named executive officer participates in these plans. See the Pension Benefits Table and “—Pension Plans” for additional information regarding these benefits. The named executive officers did not receive any above-market or preferential earnings on compensation deferred on a basis that is not tax qualified. |

|

(7) | (5) | Amounts shown in the All Other Compensation column for 20092012 include the following: |

(a) Pursuant to the TWC Savings Plan, a tax-qualified defined contribution plan available generally to TWC employees, for the 20092012 plan year, each of the named executive officers deferred a portion of his or her annual compensation and TWCthe Company contributed $11,000$11,334 as a matching contribution on the amount deferred by each named executive officer.

officer, except for Ms. Esteves who was not eligible to receive a matching contribution.(b) The Company maintains a program of life and disability insurance generally available to all salaried employees on the same basis. This group term life insurance coverage was reduced to $50,000 for each of Messrs. Britt, Marcus Hobbs and Lawrence-Apfelbaum who were each given a cash payment to cover the cost of specified coverage under a voluntary group program available to employees generally (“GUL insurance”). For 2009,2012, this cash payment was $25,152$52,896 for Mr. Britt, $2,592$4,032 for Mr. Marcus $2,160 for Mr. Hobbs and $5,490$24,285 for Mr. Lawrence-Apfelbaum. Mr. LaJoie elected to receive group term life insurance available generally to employees as well as supplemental group term life insurance coverage provided by the Company and was taxed on the imputed income. For 2009,2012, the Company paid $5,635$6,662 for Mr. LaJoie’s supplemental life insurance coverage. For a description of life insurance coverage for certain executive officers provided pursuant to the terms of their employment agreements, see “—Employment Agreements.”

(c) The amounts of personal benefits for 2012 that exceed $10,000 in the aggregate are shown in this column for 2009and consist of the aggregate incremental cost to the Company of:as follows: (i) for Mr. Britt, reimbursement of fees for financial services of $71,323$38,500 and transportation-related benefits of $157,146$410,083 related to personal use of corporate-ownedCompany-owned aircraft ($128,305) (based on fuel, landing, repositioning and catering costs and crew travel expenses related to the personal use)402,622), an automobile allowance and personal use of a Company-provided car and specially trained driver provided for security reasons (based on the cost of the car, the driver’s compensation, fuel and parking and the portion of usage that was personal); and(ii) for Messrs.Mr. Marcus, and Hobbs, reimbursement of fees for financial services of $10,855$12,440 and $19,177, respectively.the incremental cost of guests accompanying him on a business trip on Company-owned aircraft; (iii) for Ms. Esteves, reimbursement of fees for financial services of $10,000 and payments related to Ms. Esteves’s relocation to New York City in connection with joining the Company as Executive Vice President and Chief Financial Officer pursuant to the Company’s executive relocation arrangements; and (iv) for Mr. Lawrence-Apfelbaum, reimbursement of fees for financial services of $13,265 and the incremental cost of a guest accompanying him on a business trip on Company-owned aircraft. The Board has encouraged Mr. Britt to use corporate-owned or leased aircraft for security reasons. The incremental cost of any personal use is based on fuel, landing, repositioning and catering costs and crew travel expenses related to the personal use. Mr. Britt’s transportation-related benefits also include the incremental cost of his spouse accompanying him on certain business and personal trips on corporate aircraft. Mr. Hobbs and his spouse accompanied Mr. Britt on the corporate aircraft on one personal trip. There is noThe incremental cost to TWCthe Company for the use of the aircraft by Mr. Hobbs, his spouse or Mr. Britt’s spouse under these circumstances except foris limited to catering and TWC’s portion of employment taxes attributable to the income imputed to Mr. Britt and Mr. Hobbsthe executive for tax purposes.

| (6) | Mr. Marcus became President and Chief Operating Officer on December 14, 2010 having served as Senior Executive Vice President and Chief Financial Officer since January 1, 2008. He served as acting Chief Financial Officer from December 14, 2010 through July 14, 2011. Mr. Marcus’s 2012 Stock Awards include a special award of PBUs with a grant date fair value of $1,617,840. See “—Compensation Discussion and Analysis.” |

| (7) | Ms. Esteves became Executive Vice President and Chief Financial Officer on July 15, 2011. In connection with joining the Company, Ms. Esteves received cash payments in 2012 and 2011 aggregating $240,000 and $820,000, respectively, and an RSU award in 2011 to compensate her for forfeited compensation from her prior employer. See “—Employment Agreements—Irene M. Esteves.” |

| (8) | Mr. LaJoie became Executive Vice President and Chief Technology and Network Operations Officer in January 2013 having served as Executive Vice President and Chief Technology Officer since January 2004. |

Grants of Plan-Based Awards

The following table presents information with respect to each award of plan-based compensation to each named executive officer in 2009,2012, including (a) annual cash awards under the 162(m) Bonus Plan and 2012 TWCIP, and (b) awards of stock options to purchase Common Stock and TWC RSUs granted under the TWC Stock Incentive Plan.

The following table reflects (a) the antidilution adjustmentsPlan that are subject to the TWC stock option exercise pricesperformance-based vesting conditions (“PBOs” and number“PBUs,” respectively) and class(c) awards of shares underlying TWC stock options to purchase Common Stock and RSUs and (b)granted under the Separation-related make-up awards granted in May 2009. These antidilution adjustments were made in March 2009 in connectionStock Plan with the Separation and were intended to maintain the awards’ values following the payment of the Special Dividend,

38

the Reverse Stock Split and the Recapitalization. See “—Compensation Discussion and Analysis—Separation from Time Warner.”

GRANTS OF PLAN-BASED AWARDS

DURING 20092012

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | Stock

| | Option

| | | | |

| | | | | | | | | | | | | Awards:

| | Awards:

| | | | Grant Date

|

| | | | | | | | | | | | | Number of

| | Number of

| | Exercise or

| | Fair Value

|

| | | | | | | Estimated Possible Payouts Under

| | Shares of

| | Securities

| | Base Price

| | of Stock

|

| | | Grant

| | Approval

| | Non-Equity Incentive Plan Awards | | Stock or

| | Underlying

| | of Option

| | and Option

|

Name | | Date | | Date(1) | | Threshold | | Target | | Maximum | | Units | | Options | | Awards(2) | | Awards |

| |

| Glenn A. Britt | | | | (3) | | | | | | $ | 2,500,000 | | | $ | 5,000,000 | | | $ | 7,500,000 | | | | | | | | | | | | | | | | | |

| | | | 2/13/2009 | (4) | | | 2/13/2009 | | | | | | | | | | | | | | | | | | | | 380,059 | | | $ | 23.48 | | | $ | 3,550,815 | |

| | | | 5/11/2009 | (5) | | | 5/8/2009 | | | | | | | | | | | | | | | | | | | | 5,427 | | | $ | 33.80 | | | $ | 62,309 | |

| | | | 8/3/2009 | | | | 7/29/2009 | | | | | | | | | | | | | | | | | | | | 159,873 | | | $ | 34.24 | | | $ | 2,310,165 | |

| | | | 2/13/2009 | (6) | | | 2/13/2009 | | | | | | | | | | | | | | | | 95,372 | | | | | | | | | | | $ | 2,324,387 | |

| Robert D. Marcus | | | | (3) | | | | | | $ | 700,000 | | | $ | 1,400,000 | | | $ | 2,100,000 | | | | | | | | | | | | | | | | | |

| | | | 2/13/2009 | (4) | | | 2/13/2009 | | | | | | | | | | | | | | | | | | | | 114,017 | | | $ | 23.48 | | | $ | 1,041,637 | |

| | | | 5/11/2009 | (5) | | | 5/8/2009 | | | | | | | | | | | | | | | | | | | | 7,737 | | | $ | 33.80 | | | $ | 84,977 | |

| | | | 2/13/2009 | (6) | | | 2/13/2009 | | | | | | | | | | | | | | | | 28,612 | | | | | | | | | | | $ | 697,338 | |

| Landel C. Hobbs | | | | (3) | | | | | | $ | 1,050,000 | | | $ | 2,100,000 | | | $ | 3,150,000 | | | | | | | | | | | | | | | | | |

| | | | 2/13/2009 | (4) | | | 2/13/2009 | | | | | | | | | | | | | | | | | | | | 190,029 | | | $ | 23.48 | | | $ | 1,736,067 | |

| | | | 5/11/2009 | (5) | | | 5/8/2009 | | | | | | | | | | | | | | | | | | | | 13,596 | | | $ | 33.80 | | | $ | 150,706 | |

| | | | 2/13/2009 | (6) | | | 2/13/2009 | | | | | | | | | | | | | | | | 47,686 | | | | | | | | | | | $ | 1,162,194 | |

| | | | 5/11/2009 | (7) | | | 5/8/2009 | | | | | | | | | | | | | | | | 5,448 | | | | | | | | | | | $ | 184,142 | |

| Michael LaJoie | | | | (3) | | | | | | $ | 262,500 | | | $ | 525,000 | | | $ | 787,500 | | | | | | | | | | | | | | | | | |

| | | | 2/13/2009 | (4) | | | 2/13/2009 | | | | | | | | | | | | | | | | | | | | 58,196 | | | $ | 23.48 | | | $ | 531,667 | |

| | | | 5/11/2009 | (5) | | | 5/8/2009 | | | | | | | | | | | | | | | | | | | | 10,176 | | | $ | 33.80 | | | $ | 108,274 | |

| | | | 2/13/2009 | (6) | | | 2/13/2009 | | | | | | | | | | | | | | | | 14,603 | | | | | | | | | | | $ | 355,907 | |

| | | | 5/11/2009 | (7) | | | 5/8/2009 | | | | | | | | | | | | | | | | 1,296 | | | | | | | | | | | $ | 43,805 | |

| Marc Lawrence-Apfelbaum | | | | (3) | | | | | | $ | 275,000 | | | $ | 550,000 | | | $ | 825,000 | | | | | | | | | | | | | | | | | |

| | | | 2/13/2009 | (4) | | | 2/13/2009 | | | | | | | | | | | | | | | | | | | | 55,742 | | | $ | 23.48 | | | $ | 509,248 | |

| | | | 5/11/2009 | (5) | | | 5/8/2009 | | | | | | | | | | | | | | | | | | | | 14,404 | | | $ | 33.80 | | | $ | 149,887 | |

| | | | 2/13/2009 | (6) | | | 2/13/2009 | | | | | | | | | | | | | | | | 6,264 | | | | | | | | | | | $ | 340,887 | |

| | | | 5/11/2009 | (7) | | | 5/8/2009 | | | | | | | | | | | | | | | | 1,231 | | | | | | | | | | | $ | 41,608 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Grant

Date | | | Estimated Possible Payouts Under

Non-Equity Incentive Plan Awards(1) | | | Estimated Possible

Payouts Under

Equity Incentive Plan Awards | | Stock

Awards:

Number of

Shares of

Stock or

Units(3) | | Option

Awards:

Number of

Securities

Underlying

Options(2) | | Exercise

or Base

Price of

Option

Awards(4) | | | Grant Date

Fair Value

of Stock and

Option

Awards(2)(3) | |

Name | | | Threshold | | | Target | | | Maximum | | | PBO(2) | | | | PBU(3) | | | | |

Glenn A. Britt | | | | | | $ | 3,125,000 | | | $ | 6,250,000 | | | $ | 9,375,000 | | | | | | | | | | | | | | | | | | | |

| | | 2/16/2012 | | | | | | | | | | | | | | | 102,164 | | | | | | | | 204,327 | | $ | 77.04 | | | $ | 5,164,373 | |

| | | 2/16/2012 | | | | | | | | | | | | | | | | | | | 47,600 | | — | | | | | | | | $ | 3,667,104 | |

Robert D. Marcus | | | | | | $ | 1,250,000 | | | $ | 2,500,000 | | | $ | 3,750,000 | | | | | | | | | | | | | | | | | | | |

| | | 2/16/2012 | | | | | | | | | | | | | | | 54,087 | | | | | | | | 108,174 | | $ | 77.04 | | | $ | 2,734,098 | |

| | | 2/16/2012 | | | | | | | | | | | | | | | | | | | 46,200 | | — | | | | | | | | $ | 3,559,248 | |

Irene M. Esteves | | | | | | $ | 600,000 | | | $ | 1,200,000 | | | $ | 1,800,000 | | | | | | | | | | | | | | | | | | | |

| | | 2/16/2012 | | | | | | | | | | | | | | | 36,058 | | | | | | | | 72,116 | | $ | 77.04 | | | $ | 1,822,732 | |

| | | 2/16/2012 | | | | | | | | | | | | | | | | | | | 16,800 | | — | | | | | | | | $ | 1,294,272 | |

Michael LaJoie | | | | | | $ | 320,833 | | | $ | 641,667 | | | $ | 962,500 | | | | | | | | | | | | | | | | | | | |

| | | 2/16/2012 | | | | | | | | | | | | | | | 13,522 | | | | | | | | 27,044 | | $ | 77.04 | | | $ | 683,537 | |

| | | 2/16/2012 | | | | | | | | | | | | | | | | | | | 6,300 | | — | | | | | | | | $ | 485,352 | |

Marc Lawrence-

Apfelbaum | | | | | | $ | 320,833 | | | $ | 641,667 | | | $ | 962,500 | | | | | | | | | | | | | | | | | | | |

| | | 2/16/2012 | | | | | | | | | | | | | | | 18,931 | | | | | | | | 37,861 | | $ | 77.04 | | | $ | 956,945 | |

| | | 2/16/2012 | | | | | | | | | | | | | | | | | | | 8,820 | | — | | | | | | | | $ | 679,493 | |

| | |

| (1) | | On May 8, 2009, the Compensation Subcommittee approved the Separation-relatedmake-up awards to be made to the named executive officers on May 11, 2009. |

|

(2) | | The exercise price for the awards of stock options under the TWC Stock Incentive Plan was determined based on the closing sale price of Common Stock on the date of grant, and, with respect to the awards on February 13, 2009, reflect the antidilution adjustments as a result of the Separation. |

|

(3) | | Reflects the threshold, target and maximum payout amounts under the 20092012 TWCIP of non-equity incentive plan awards that were awarded in 20092012 and were paid out in 20102013 under the 162(m) Bonus Plan and 2012 TWCIP. The target payout amount for each named executive officer was established in accordance with the terms of the named executive officer’s employment agreement.agreement, as may be increased by the Compensation Committee from time to time. Under the TWCIP, each maximum payout amount reflects 150% of the applicable target payout amount. For a discussion of 2012 TWCIP performance goals, see “Compensation“—Compensation Discussion and Analysis.” |

|

(4)(2) | | Reflects the number of shares of Common Stock underlying awards of stock options to purchase Common Stock and PBOs under the TWCCompany’s Stock Incentive Plan and the full grant date fair value of each award. For information about the assumptions used in these calculations, see Notes 3 and 13 to the 20092012 Form 10-K, which, among other things, presents weighted-average assumptions on a combined basis for retirement-eligible employees who meet the age andnon-retirement-eligible employees. service requirements for retirement eligibility under the terms of the awards (“retirement eligible”) and those employees who are not retirement eligible. In 2012, the vesting of a portion of the stock option award to executive officers was subject to a performance-based vesting condition. The amounts provided in this table reflect specific assumptions for (a) Mr.Messrs. Britt and Lawrence-Apfelbaum who waswere retirement eligible at the time of the 20092012 awards, and (b) the other named executive officers, who were not retirement eligible.eligible under the terms of the awards. Specifically, the amounts with respect to February 20092012 awards of stock options for the named executive officers other than Mr. Brittand PBOs were calculated using the Black-Scholes option pricing model, based on the following assumptions used in developing the grant valuations for awards: an expected volatility of 33.42%30.03%, calculated using a 75%-25% weighted average of implied volatilities of TWC |

39

| | |

| | traded options and the historical stock price volatility of a comparable peer group of publicly-traded companies; an expected term to exercise of 6.496.43 years from the date of grant; a risk-free interest rate of 2.73%1.35%; and a dividend yield of 0%2.91%. Because Mr.Messrs. Britt wasand Lawrence-Apfelbaum were retirement eligible, different assumptions were usedevaluated in developing grant valuations for his Februarytheir 2012 awards and August 2009 awards, respectively: an expected volatility of 33.71% and 35.13%;the assumptions used were the same except for using an expected term to exercise of 6.666.42 years from the date of grant;grant, See “—Outstanding Equity Awards” below. For a risk-free interest rate of 2.78% and 3.34%; and a dividend yield of 0%. The assumptions used in the calculationsdiscussion of the grant date fair value ofperformance goals applicable to the Separation-relatedmake-up stock option awards granted in May 2009 were based on slightly different assumptions as a result of their varied vestingPBOs, see “—Compensation Discussion and expiration dates. See “Outstanding Equity Awards at December 31, 2009.Analysis.” The |

| (3) | Reflects the number of shares underlying these options and the exercise price reflect the antidilution adjustments. |

|

(5) | | For each named executive officer, reflects the aggregate number of stock options covered by more than one Separation-relatedmake-up stock option award. Each of these Separation-relatedmake-up stock option awards has the same award date and exercise price, but has different vesting and expiration dates based on the terms of the related Time Warner equity award. As a result of the different expiration dates, the assumptions used to determine the grant date fair value of these awards were slightly different. See “Compensation Discussion and Analysis” and “Outstanding Equity Awards at December 31, 2009.” |

|

(6) | | ReflectsCommon Stock underlying awards of RSUsPBUs under the TWC Stock Incentive Plan and the full grant date fair value of each award. See footnote (3)(1) to the Summary Compensation Table for the assumptions used to determine the grant-date fair value of the stock awards. Each of Messrs. Britt, Marcus, Hobbs and LaJoie elected to receive the Special Dividend retained distribution on his outstanding RSUs as Special Dividend RSUs; Mr. Lawrence-Apfelbaum elected to receive the Special Dividend retained cash distribution on his outstanding RSUs. The Special Dividend RSUs issued in connection with the February 2009 award of RSUs are reflected in the stock award totals and the grant date fair values in the table, and Mr. Lawrence-Apfelbaum’s Special Dividend retained cash distribution is reflected in the grant date fair value. |

|

(7) | | Reflects the Separation-relatedmake-up RSUs under the TWC Stock Incentive Plan and the full grant date fair value of the award. See footnote (3) to the Summary Compensation Table for the assumptions used to determine the grant date fair value and “Compensation Discussion and Analysis” forFor a discussion of the reasonperformance goals applicable to the PBUs, see “—Compensation Discussion and Analysis.” All of the stock awards in 2012 to named executive officers were awarded as PBUs. |

| (4) | The exercise price for the award.awards of stock options under the Stock Plan was determined based on the closing sale price of Common Stock on the date of grant. |

The stock options granted in February and August 20092012 shown in the table above become exercisable, or vest, in installments of 25% on the anniversary of each grant date over a four-year period, assuming continued employment and, in the case of PBOs, subject to the satisfaction and certification of the applicable performance condition, and expire ten years from the grant date. The dates on which theSeparation-relatedmake-up stock option awards become exercisable vary. TheSeparation-relatedmake-up stock options awarded to (a) Mr. Marcus become exercisable three years after the Separation (March 12, 2012); (b) Mr. Britt, who is retirement eligible under the terms of the award agreement, become exercisable five years after the grant date of the related Time Warner stock option; (c) others whose Time Warner stock options were forfeited become exercisable on the schedule of the related forfeited Time Warner stock options; and (d) others whose Time Warner stock options experienced a shortened term become exercisable one year after the Separation (March 12, 2010). The stock options are subject to accelerated vesting upon the occurrence of certain events such as retirement, death or disability. The exercise price of the stock options equaled the fair market value of the Common Stock on the date of grant as adjusted pursuant to the antidilution adjustments. In addition, holders of the stock options or PBOs do not receive dividends or dividend equivalents or have any voting rights with respect to the shares of Common Stock underlying the stock options.

The satisfaction of the performance condition for continued vesting of the PBOs awarded in 2012 was certified in January 2013.The awards of TWC RSUsPBUs granted in February 20092012 vest in equal installments on each of the third and fourth anniversaries of the date of grant, and the Separation-relatedmake-up awards vest on the original vesting date of the related Time Warner equity award assumingsubject to continued employment and subject to accelerated vesting upon the occurrence of certain events such as retirement, death or disability. Holderssatisfaction and certification of the applicable performance condition. Generally, holders of RSUs are entitled to receive dividend equivalents on unvested RSUs,or retained distributions if and when regular cash dividends are paid on outstanding shares of Common Stock and at the same rate. In the case of PBUs, the receipt of dividend equivalents is subject to the satisfaction and certification of the applicable performance condition. The satisfaction of the performance condition for continued vesting of the PBUs awarded in 2012 was certified in January 2013. The awards of RSUs confer no voting rights on holders and are subject to restrictions on transfer and forfeiture prior to vesting. See “—Compensation Discussion and Analysis—20092012 Long-Term Incentive Program andProgram—Equity-Based Awards.”

40

Outstanding Equity Awards

The following table provides information about the outstanding awards of options to purchase the Company’s Common Stock, and Time Warner Common Stockincluding PBOs, and the aggregate TWCRSUs and Time Warner RSUsPBUs held by each named executive officer on December 31, 2009.

2012. The

information in this table reflects (1) antidilution adjustmentssatisfaction of the one-year performance-based condition related to the

vesting of the PBOs and PBUs awarded in 2012 was certified in January 2013.In connection with the Separation, on March 12, 2009, TWC paid a special cash dividend of $10.27 per share ($30.81 per share after giving effect to the 1-for-3 reverse stock option exercise pricessplit discussed below, aggregating $10.856 billion) to holders of record on March 11, 2009 of its outstanding Class A common stock and number and kind of shares underlying (a) TWCClass B common stock options and RSUs, as applicable, as a result of(the “Special Dividend”). Following the payment of the Special Dividend, each outstanding share of Class A common stock and Class B common stock was automatically converted (the “Recapitalization”) into one share of Common Stock. Effective immediately after the Recapitalization, the Company implemented a reverse stock split of the Common Stock at a 1-for-3 ratio (the “Reverse Stock Split”). Unless otherwise indicated in this Proxy Statement, information about TWC’s equity securities prior to March 12, 2009 has been adjusted to reflect the Separation, the Recapitalization and the Reverse Stock Split and the Recapitalization and (b)Split. As of December 31, 2012, all Time Warner stock options and RSUs as a result of Time Warner’s Spin-Off Dividend,one-for-three reverse stock split andspin-off distribution of its interest in AOL Inc. and (2)previously held by the forfeiture and vesting of Time Warner stock options and RSUs and the shortened exercise periods of certain Time Warner stock options as a result of the Separation. General information about the impact of the Separation on the awards is provided in certain footnotes. See “—Compensation Discussion and Analysis—Separation from Time Warner.”

named executive officers have either been exercised or have expired.OUTSTANDING EQUITY AWARDS AT

DECEMBER 31, 20092012

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Option Awards(1) | | | Stock Awards | |

| | | | | | | | | | | | | | | | | | | | | Market

| |

| | | | | | Number of

| | | Number of

| | | | | | | | | Number of

| | | Value of

| |

| | | | | | Securities

| | | Securities

| | | | | | | | | Shares or

| | | Shares or

| |

| | | | | | Underlying

| | | Underlying

| | | | | | | | | Units of

| | | Units of

| |

| | | | | | Unexercised

| | | Unexercised

| | | Option

| | | Option

| | | Stock That

| | | Stock That

| |

| | | Date of

| | | Options

| | | Options

| | | Exercise

| | | Expiration

| | | Have Not

| | | Have Not

| |

Name | | Option Grant | | | Exercisable | | | Unexercisable | | | Price | | | Date | | | Vested(2) | | | Vested(3) | |

| |

Glenn A. Britt | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Time Warner Cable | | | | | | | | | | | | | | | | | | | | | | | 262,037 | | | $ | 10,845,711 | |

| | | | 4/2/2007 | | | | 62,370 | | | | 62,373 | | | $ | 47.95 | | | | 4/1/2017 | | | | | | | | | |

| | | | 3/3/2008 | | | | 72,372 | | | | 217,121 | | | $ | 35.60 | | | | 3/2/2018 | | | | | | | | | |

| | | | 2/13/2009 | | | | — | | | | 380,059 | | | $ | 23.48 | | | | 2/12/2019 | | | | | | | | | |

| | | | 5/11/2009 | | | | — | | | | 2,274 | | | $ | 33.80 | | | | 2/17/2015 | | | | | | | | | |

| | | | 5/11/2009 | | | | — | | | | 3,153 | | | $ | 33.80 | | | | 3/2/2016 | | | | | | | | | |

| | | | 8/3/2009 | | | | — | | | | 159,873 | | | $ | 34.24 | | | | 8/2/2019 | | | | | | | | | |

| Time Warner | | | | | | | | | | | | | | | | | | | | | | | — | | | | — | |

| | | | 3/15/2000 | | | | 45,137 | | | | — | | | $ | 120.04 | | | | 3/14/2010 | | | | | | | | | |

| | | | 1/18/2001 | | | | 54,162 | | | | — | | | $ | 101.70 | | | | 1/17/2011 | | | | | | | | | |

| | | | 2/27/2001 | | | | 127,546 | | | | — | | | $ | 94.12 | | | | 2/26/2011 | | | | | | | | | |

| | | | 4/6/2001 | | | | 1,891 | | | | — | | | $ | 80.10 | | | | 4/5/2011 | | | | | | | | | |

| | | | 4/17/2001 | | | | 18,455 | | | | — | | | $ | 91.73 | | | | 4/16/2011 | | | | | | | | | |

| | | | 8/24/2001 | | | | 306,910 | | | | — | | | $ | 85.06 | | | | 8/23/2011 | | | | | | | | | |

| | | | 2/15/2002 | | | | 48,144 | | | | — | | | $ | 55.36 | | | | 2/14/2012 | | | | | | | | | |

| | | | 2/13/2004 | | | | 108,321 | | | | — | | | $ | 35.89 | | | | 2/12/2014 | | | | | | | | | |

| | | | 2/18/2005 | | | | 113,136 | | | | — | | | $ | 37.32 | | | | 3/12/2014 | | | | | | | | | |

| | | | 3/3/2006 | | | | 87,115 | | | | — | | | $ | 36.14 | | | | 3/12/2014 | | | | | | | | | |

Robert D. Marcus | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Time Warner Cable | | | | | | | | | | | | | | | | | | | | | | | 71,915 | | | $ | 2,976,562 | |

| | | | 4/2/2007 | | | | 14,032 | | | | 14,035 | | | $ | 47.95 | | | | 4/1/2017 | | | | | | | | | |

| | | | 3/3/2008 | | | | 21,711 | | | | 65,136 | | | $ | 35.60 | | | | 3/2/2018 | | | | | | | | | |

| | | | 2/13/2009 | | | | — | | | | 114,017 | | | $ | 23.48 | | | | 2/12/2019 | | | | | | | | | |

| | | | 5/11/2009 | | | | — | | | | 855 | | | $ | 33.80 | | | | 2/13/2013 | | | | | | | | | |

| | | | 5/11/2009 | | | | — | | | | 1,697 | | | $ | 33.80 | | | | 2/12/2014 | | | | | | | | | |

| | | | 5/11/2009 | | | | — | | | | 1,672 | | | $ | 33.80 | | | | 2/17/2015 | | | | | | | | | |

| | | | 5/11/2009 | | | | — | | | | 2,572 | | | $ | 33.80 | | | | 3/2/2016 | | | | | | | | | |

| | | | 5/11/2009 | | | | — | | | | 941 | | | $ | 33.80 | | | | 6/20/2016 | | | | | | | | | |

41

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Option Awards(1) | | | Stock Awards | |

Name | | Date of

Option

Grant | | | Number of

Securities

Underlying

Unexercised

Options

Exercisable | | | Number of

Securities

Underlying

Unexercised

Options

Unexercisable | | | Equity

Incentive

Plan

Awards:

Number

of

Securities

Underlying

Unexercised

Unearned

Options | | | Option

Exercise

Price | | | Option

Expiration

Date | | | Number of

Shares or

Units of

Stock That

Have Not

Vested(2) | | | Market Value

of Shares or

Units of

Stock

That Have

Not Vested(3) | | | Equity

Incentive

Plan

Awards:

Number of

Unearned

Units of

Stock That

Have

Not

Vested(2) | | | Equity

Incentive

Plan

Awards:

Market

Value of

Unearned

Units of

Stock That

Have Not

Vested(3) | |

Glenn A. Britt | | | | | | | | | | | | | | | | | | | | | | | | | | | 159,415 | | | $ | 15,493,544 | | | | 47,600 | | | $ | 4,626,244 | |

| | | 2/13/2009 | | | | 114,946 | | | | 95,017 | | | | | | | $ | 23.48 | | | | 2/12/2019 | | | | | | | | | | | | | | | | | |

| | | 8/3/2009 | | | | 79,936 | | | | 39,969 | | | | | | | | 34.24 | | | | 8/2/2019 | | | | | | | | | | | | | | | | | |

| | | 2/12/2010 | | | | 193,966 | | | | 193,966 | | | | | | | | 45.15 | | | | 2/11/2020 | | | | | | | | | | | | | | | | | |

| | | 2/17/2011 | | | | 54,664 | | | | 163,996 | | | | | | | | 72.05 | | | | 2/16/2021 | | | | | | | | | | | | | | | | | |

| | | 2/16/2012 | | | | — | | | | 204,327 | | | | 102,164 | | | | 77.04 | | | | 2/15/2022 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

Robert D. Marcus | | | | | | | | | | | | | | | | | | | | | | | | | | | 68,719 | | | $ | 6,678,800 | | | | 46,200 | | | $ | 4,490,178 | |

| | | 2/13/2009 | | | | — | | | | 28,505 | | | | | | | $ | 23.48 | | | | 2/12/2019 | | | | | | | | | | | | | | | | | |

| | | 2/12/2010 | | | | 55,172 | | | | 80,173 | | | | | | | | 45.15 | | | | 2/11/2020 | | | | | | | | | | | | | | | | | |

| | | 2/17/2011 | | | | 32,799 | | | | 98,397 | | | | | | | | 72.05 | | | | 2/16/2021 | | | | | | | | | | | | | | | | | |

| | | 2/16/2012 | | | | — | | | | 108,174 | | | | 54,087 | | | | 77.04 | | | | 2/15/2022 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

Irene M. Esteves | | | | | | | | | | | | | | | | | | | | | | | | | | | 48,028 | | | $ | 4,667,841 | | | | 16,800 | | | $ | 1,632,792 | |

| | | 2/16/2012 | | | | — | | | | 72,116 | | | | 36,058 | | | $ | 77.04 | | | | 2/15/2022 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

Michael LaJoie | | | | | | | | | | | | | | | | | | | | | | | | | | | 23,201 | | | $ | 2,254,905 | | | | 6,300 | | | $ | 612,297 | |

| | | 4/2/2007 | | | | 7,464 | | | | — | | | | | | | $ | 47.95 | | | | 4/1/2017 | | | | | | | | | | | | | | | | | |

| | | 2/13/2009 | | | | — | | | | 14,549 | | | | | | | | 23.48 | | | | 2/12/2019 | | | | | | | | | | | | | | | | | |

| | | 2/12/2010 | | | | — | | | | 27,156 | | | | | | | | 45.15 | | | | 2/11/2020 | | | | | | | | | | | | | | | | | |

| | | 2/17/2011 | | | | 7,971 | | | | 23,918 | | | | | | | | 72.05 | | | | 2/16/2021 | | | | | | | | | | | | | | | | | |

| | | 2/16/2012 | | | | — | | | | 27,044 | | | | 13,522 | | | | 77.04 | | | | 2/15/2022 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

Marc Lawrence- Apfelbaum | | | | | | | | | | | | | | | | | | | | | | | | | | | 20,127 | | | $ | 1,956,143 | | | | 8,820 | | | $ | 857,216 | |

| | | 2/13/2009 | | | | 10 | | | | 13,937 | | | | | | | $ | 23.48 | | | | 2/12/2019 | | | | | | | | | | | | | | | | | |

| | | 2/12/2010 | | | | 27,155 | | | | 27,156 | | | | | | | | 45.15 | | | | 2/11/2020 | | | | | | | | | | | | | | | | | |

| | | 2/17/2011 | | | | 9,329 | | | | 27,990 | | | | | | | | 72.05 | | | | 2/16/2021 | | | | | | | | | | | | | | | | | |

| | | 2/16/2012 | | | | — | | | | 37,861 | | | | 18,931 | | | | 77.04 | | | | 2/15/2022 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Option Awards(1) | | | Stock Awards | |

| | | | | | | | | | | | | | | | | | | | | Market

| |

| | | | | | Number of

| | | Number of

| | | | | | | | | Number of

| | | Value of

| |

| | | | | | Securities

| | | Securities

| | | | | | | | | Shares or

| | | Shares or

| |

| | | | | | Underlying

| | | Underlying

| | | | | | | | | Units of

| | | Units of

| |

| | | | | | Unexercised

| | | Unexercised

| | | Option

| | | Option

| | | Stock That

| | | Stock That

| |

| | | Date of

| | | Options

| | | Options

| | | Exercise

| | | Expiration

| | | Have Not

| | | Have Not

| |

Name | | Option Grant | | | Exercisable | | | Unexercisable | | | Price | | | Date | | | Vested(2) | | | Vested(3) | |

| |

| Time Warner | | | | | | | | | | | | | | | | | | | | | | | — | | | | — | |

| | | | 3/15/2000 | | | | 25,277 | | | | — | | | $ | 120.04 | | | | 3/14/2010 | | | | | | | | | |

| | | | 1/18/2001 | | | | 144,429 | | | | — | | | $ | 101.70 | | | | 1/17/2011 | | | | | | | | | |

| | | | 4/6/2001 | | | | 1,003 | | | | — | | | $ | 80.10 | | | | 4/5/2011 | | | | | | | | | |

| | | | 2/15/2002 | | | | 60,631 | | | | — | | | $ | 55.36 | | | | 2/14/2012 | | | | | | | | | |

| | | | 2/14/2003 | | | | 12,036 | | | | — | | | $ | 21.43 | | | | 3/12/2012 | | | | | | | | | |

| | | | 2/13/2004 | | | | 36,108 | | | | — | | | $ | 35.89 | | | | 3/12/2012 | | | | | | | | | |

| | | | 2/18/2005 | | | | 26,961 | | | | — | | | $ | 37.32 | | | | 3/12/2012 | | | | | | | | | |

| | | | 3/3/2006 | | | | 34,374 | | | | — | | | $ | 36.14 | | | | 3/12/2012 | | | | | | | | | |

| | | | 6/21/2006 | | | | 12,036 | | | | — | | | $ | 35.79 | | | | 3/12/2012 | | | | | | | | | |

Landel C. Hobbs | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Time Warner Cable | | | | | | | | | | | | | | | | | | | | | | | 126,526 | | | $ | 5,236,911 | |

| | | | 4/2/2007 | | | | 25,467 | | | | 25,470 | | | $ | 47.95 | | | | 4/1/2017 | | | | | | | | | |

| | | | 3/3/2008 | | | | 36,186 | | | | 108,560 | | | $ | 35.60 | | | | 3/2/2018 | | | | | | | | | |

| | | | 2/13/2009 | | | | — | | | | 190,029 | | | $ | 23.48 | | | | 2/12/2019 | | | | | | | | | |

| | | | 5/11/2009 | | | | — | | | | 2,724 | | | $ | 33.80 | | | | 2/12/2014 | | | | | | | | | |

| | | | 5/11/2009 | | | | — | | | | 3,461 | | | $ | 33.80 | | | | 2/17/2015 | | | | | | | | | |

| | | | 5/11/2009 | | | | — | | | | 2,869 | | | $ | 33.80 | | | | 3/2/2016 | | | | | | | | | |

| | | | 5/11/2009 | | | | — | | | | 4,542 | | | $ | 33.80 | | | | 3/2/2016 | | | | | | | | | |

| Time Warner | | | | | | | | | | | | | | | | | | | | | | | — | | | | — | |

| | | | 3/15/2000 | | | | 10,833 | | | | — | | | $ | 120.04 | | | | 3/14/2010 | | | | | | | | | |

| | | | 10/4/2000 | | | | 36,108 | | | | — | | | $ | 115.41 | | | | 10/3/2010 | | | | | | | | | |

| | | | 1/18/2001 | | | | 108,321 | | | | — | | | $ | 101.70 | | | | 3/12/2010 | | | | | | | | | |

| | | | 9/27/2001 | | | | 96,287 | | | | — | | | $ | 65.68 | | | | 3/12/2010 | | | | | | | | | |

| | | | 2/13/2004 | | | | 18,053 | | | | — | | | $ | 35.89 | | | | 3/12/2010 | | | | | | | | | |

| | | | 2/18/2005 | | | | 23,109 | | | | — | | | $ | 37.32 | | | | 3/12/2010 | | | | | | | | | |

| | | | 3/3/2006 | | | | 28,816 | | | | — | | | $ | 36.14 | | | | 3/12/2010 | | | | | | | | | |

Michael LaJoie | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Time Warner Cable | | | | | | | | | | | | | | | | | | | | | | | 40,248 | | | $ | 1,665,865 | |

| | | | 4/2/2007 | | | | 8,731 | | | | 8,733 | | | $ | 47.95 | | | | 4/1/2017 | | | | | | | | | |

| | | | 3/3/2008 | | | | — | | | | 33,248 | | | $ | 35.60 | | | | 3/2/2018 | | | | | | | | | |

| | | | 2/13/2009 | | | | — | | | | 58,196 | | | $ | 23.48 | | | | 2/12/2019 | | | | | | | | | |

| | | | 5/11/2009 | | | | — | | | | 953 | | | $ | 33.80 | | | | 2/14/2012 | | | | | | | | | |

| | | | 5/11/2009 | | | | — | | | | 2,905 | | | $ | 33.80 | | | | 2/12/2014 | | | | | | | | | |

| | | | 5/11/2009 | | | | — | | | | 2,920 | | | $ | 33.80 | | | | 2/17/2015 | | | | | | | | | |

| | | | 5/11/2009 | | | | — | | | | 1,007 | | | $ | 33.80 | | | | 3/2/2016 | | | | | | | | | |

| | | | 5/11/2009 | | | | | | | | 2,391 | | | $ | 33.80 | | | | 3/2/2016 | | | | | | | | | |

| Time Warner | | | | | | | | | | | | | | | | | | | | | | | — | | | | — | |

| | | | 3/15/2000 | | | | 3,432 | | | | — | | | $ | 120.04 | | | | 3/14/2010 | | | | | | | | | |

| | | | 1/18/2001 | | | | 6,862 | | | | — | | | $ | 101.70 | | | | 3/12/2010 | | | | | | | | | |

| | | | 2/27/2001 | | | | 15,466 | | | | — | | | $ | 94.12 | | | | 3/12/2010 | | | | | | | | | |

| | | | 2/15/2002 | | | | 14,443 | | | | — | | | $ | 55.36 | | | | 3/12/2010 | | | | | | | | | |

| | | | 2/13/2004 | | | | 19,257 | | | | — | | | $ | 35.89 | | | | 3/12/2010 | | | | | | | | | |

| | | | 2/18/2005 | | | | 19,498 | | | | — | | | $ | 37.32 | | | | 3/12/2010 | | | | | | | | | |

| | | | 3/3/2006 | | | | 15,168 | | | | — | | | $ | 36.14 | | | | 3/12/2010 | | | | | | | | | |

Marc Lawrence-Apfelbaum | | | | | | | | | | | | | | | | | | | | | | | | |

| Time Warner Cable | | | | | | | | | | | | | | | | | | | | | | | 18,175 | | | $ | 752,263 | |

| | | | 4/2/2007 | | | | 8,731 | | | | 8,733 | | | $ | 47.95 | | | | 4/1/2017 | | | | | | | | | |

| | | | 3/3/2008 | | | | 10,614 | | | | 31,845 | | | $ | 35.60 | | | | 3/2/2018 | | | | | | | | | |

| | | | 2/13/2009 | | | | — | | | | 55,742 | | | $ | 23.48 | | | | 2/12/2019 | | | | | | | | | |

| | | | 5/11/2009 | | | | — | | | | 1,905 | | | $ | 33.80 | | | | 2/14/2012 | | | | | | | | | |

| | | | 5/11/2009 | | | | — | | | | 5,810 | | | $ | 33.80 | | | | 2/12/2014 | | | | | | | | | |

| | | | 5/11/2009 | | | | — | | | | 3,461 | | | $ | 33.80 | | | | 2/17/2015 | | | | | | | | | |

| | | | 5/11/2009 | | | | — | | | | 957 | | | $ | 33.80 | | | | 3/2/2016 | | | | | | | | | |

| | | | 5/11/2009 | | | | — | | | | 2,271 | | | $ | 33.80 | | | | 3/2/2016 | | | | | | | | | |

42

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Option Awards(1) | | | Stock Awards | |

| | | | | | | | | | | | | | | | | | | | | Market

| |

| | | | | | Number of

| | | Number of

| | | | | | | | | Number of

| | | Value of

| |

| | | | | | Securities

| | | Securities

| | | | | | | | | Shares or

| | | Shares or

| |

| | | | | | Underlying

| | | Underlying

| | | | | | | | | Units of

| | | Units of

| |

| | | | | | Unexercised

| | | Unexercised

| | | Option

| | | Option

| | | Stock That

| | | Stock That

| |

| | | Date of

| | | Options

| | | Options

| | | Exercise

| | | Expiration

| | | Have Not

| | | Have Not

| |

Name | | Option Grant | | | Exercisable | | | Unexercisable | | | Price | | | Date | | | Vested(2) | | | Vested(3) | |

| |

| Time Warner | | | | | | | | | | | | | | | | | | | | | | | — | | | | — | |

| | | | 3/15/2000 | | | | 7,548 | | | | — | | | $ | 120.04 | | | | 3/14/2010 | | | | | | | | | |

| | | | 1/18/2001 | | | | 15,094 | | | | — | | | $ | 101.70 | | | | 3/12/2010 | | | | | | | | | |

| | | | 2/27/2001 | | | | 36,087 | | | | — | | | $ | 94.12 | | | | 3/12/2010 | | | | | | | | | |

| | | | 2/15/2002 | | | | 28,886 | | | | — | | | $ | 55.36 | | | | 3/12/2010 | | | | | | | | | |

| | | | 2/13/2004 | | | | 38,515 | | | | — | | | $ | 35.89 | | | | 3/12/2010 | | | | | | | | | |

| | | | 2/18/2005 | | | | 23,109 | | | | — | | | $ | 37.32 | | | | 3/12/2010 | | | | | | | | | |

| | | | 3/3/2006 | | | | 14,412 | | | | — | | | $ | 36.14 | | | | 3/12/2010 | | | | | | | | | |

| | |